|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

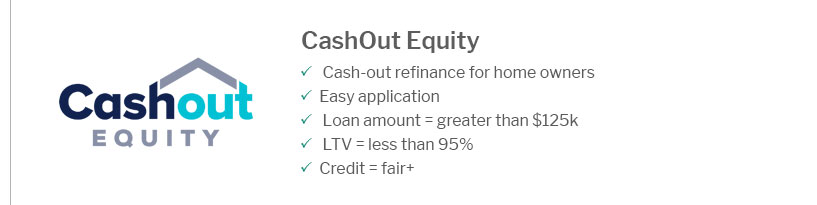

The Best Cash Out Refinance Options for HomeownersCash out refinancing can be a great financial strategy for homeowners looking to leverage their home equity. By replacing your existing mortgage with a new, larger one, you can access the difference in cash. This can be used for home improvements, debt consolidation, or other significant expenses. Understanding Cash Out RefinanceCash out refinancing is essentially a way to convert your home equity into cash. It's an attractive option when interest rates are low, and the value of your home has appreciated. But how do you know if it’s right for you? How It WorksWhen you opt for a cash out refinance, you take out a new mortgage that is larger than your current one. The difference between the old and new mortgage amount is given to you as cash. Key Benefits

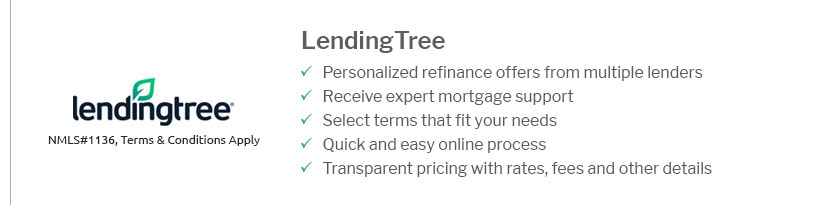

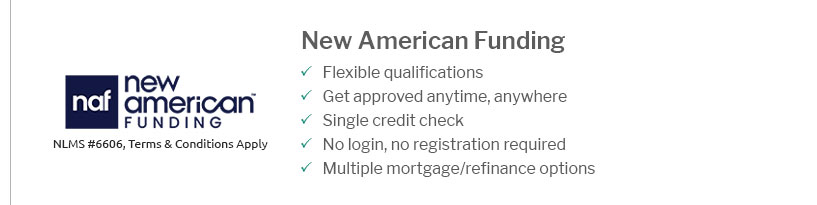

Choosing the Best OptionTo find the best cash out refinance option, consider these factors: Compare LendersDifferent lenders offer varying terms and interest rates. It's crucial to shop around and compare offers. For those in Florida, exploring options with a mortgage lender miami might yield favorable terms. Understand the CostsBe aware of closing costs, which typically range from 2% to 5% of the loan amount. Calculate these costs to ensure the refinance benefits outweigh the expenses. Common Uses for Cash Out RefinanceHomeowners use cash out refinancing for various purposes:

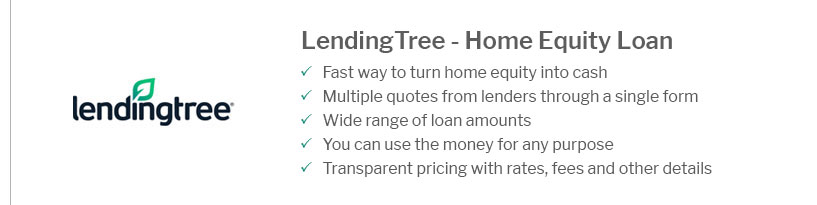

Alternatives to Cash Out RefinanceWhile cash out refinancing is a popular option, other alternatives might suit your needs better: Home Equity Line of CreditConsider a equity line of credit for more flexibility, allowing you to borrow as needed. Home Equity LoanThis option offers a lump sum at a fixed rate, which can be ideal for predictable expenses. FAQs

https://www.bankrate.com/mortgages/cash-out-refinance-rates/

Current cash-out refinance rates ; Visit Sage Home Loans site. NMLS #3304 | State Lic: 4130722. 4.8 ; Visit Optimum First Mortgage site. NMLS #240415 | State Lic: ... https://www.wellsfargo.com/mortgage/mortgage-refinance/cash-out-refinance/

Learn about cash-out refinance mortgages and find out if accessing your home equity is right for you. Check mortgage refinancing rates at Wells Fargo. https://www.nerdwallet.com/best/mortgages/cash-out-refinance-lenders

All reviewed mortgage lenders that offer cash-out refinancing were evaluated based on (1) cash-out refinance loan volume, (2) cash-out refinance origination ...

|

|---|